Overview

Sterling Development Partners is a private real estate investment and asset management firm that acquires, re-develops, and stabilizes properties in markets throughout Florida and the SouthEast. Our focus is acquiring properties with a value add component ranging from re-positioning to full scale re-zoning and development. In stabilized properties we force appreciation by making capital improvements, enhancing management and reducing operational inefficiencies. In development projects, our expertise in local re-zoning procedures enables us to maximize the value of underutilized properties. Our mission is to create communities that residents are proud to call home while generating strong returns for investors.

Focus

Investment Criteria

SDP INVESTS IN VALUE-ADD & DEVELOPMENT PROJECTS

Value-Add

Return

Moderate

Risk

Moderate

- Property provides cashflow

- Light renovations and updates required

- Fewer amenities

- Middle income rents

Development

Return

Strong

Risk

Aggressive

- Under-utilized property

- Re-zoning opportunity

- Located in strong growing market

- Multiple exit strategies

- Shorter-term investment

Deal Sourcing

Access to exclusive off market properties through personal relationships and local partnerships

Financing

Secure optimal funding structure to meet specific investment and project criteria

Analysis & Due Diligence

Focus on downside protection with conservative in-house underwriting and stress testing

Acquisition

Efficient and timely execution with a focus on structuring deal terms to favor investors and retain upside potential

Risk Management

Conservative forecasting combined with preferred returns and a waterfall model that focuses on capital preservation

Value Enhancement

Forced appreciation through capital improvements, reduction of op-ex inefficiencies and/or re-zoning for devleopment

Sale

Leveraging in-house marketing strategies to maximize return and timing based on market conditions at desired exit point

Financial Freedom

Through Passive Investing

In Real Estate Syndications

Why Invest In Multifamily Real Estate?

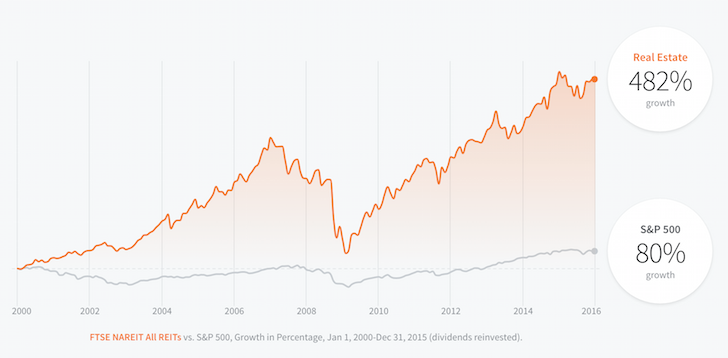

Better Returns Than the Stock Market

The average stock market return over the last 15 years was just over 7%. But did you know that after fees, taxes and inflation, the actual return was just 2.5%?

On the other hand, real estate syndications routinely yield average annual returns of 13% or more and that’s after fees, is taxed at a much lower rate (if at all), and makes a great hedge against inflation. For more information, read this special report.

Better Performance During the Last Recession

We love the low risk profile of multifamily! Over the past few decades, multifamily properties have been less volatile than the stock market and residential real estate. For example, during the Great Recession, Freddie Mac single family loan delinquencies peaked at 4% while delinquency for multifamily loans hovered around 0.4%. Multifamily delinquency rate…at its peak…was 90% lower than the residential rate in the Great Recession.

There is no other investment class on the planet with such a low risk profile and above-average returns.

Unique Tax Advantages

Real estate offers tax advantages over nearly every other investment including stocks, bonds, businesses, precious metals, and even oil.

Our investors are able to benefit from legal tax avoidance and deferment methods encouraged by the U.S. tax code, including depreciation, 1031 Exchanges and tax-free cash-out refinances.

You can learn more about the tax advantages of real estate from our good friends at the Bigger Pockets.

Passive Income and Generational Wealth

Investing in multifamily is the best way to create passive income so that you can become financially free. We look for properties with an average cash on cash return of 8%+ over 5 years. That means you’ll get a check in the mailbox every quarter. Make your money work hard for you and continue your journey to financial freedom.

We strive to double your money in five to six years, and frequently the returns are much higher. Investing in multifamily will help you create generational wealth, the kind that lets you retire permanently and pass it on to your children.

Why Partner with Sterling Development for Your Next Real Estate Syndication?

High-Quality Investments

We are constantly sourcing high quality deals so that you have a consistent selection of high-quality multifamily investments to choose from. For most investments, you don’t need to be an accredited investor (but you do need to join), and the minimum investment is typically $75,000. So start small and grow with us over time. Join now to check out some of our active investment opportunities.

Conservative Underwriting

We’re ultra-conservative when we “underwrite” (or analyze) deals. For example, we have extra funds at closing and continue to add to those reserves from cash flow; we secure either long-term debt or if do require a bridge loan, we have one or more options to extensions (this is important should there be a market correction); we look for value-add deals with strong cash flow that we can stabilize in 12 to 24 months. This is how we protect you from any possible market correction.

Communication and Transparency

We’re an open book to answer any questions or concerns you have about an investment. Once we close, we provide monthly reports to you so you know exactly what’s going on at any given time. We’re there if you need to contact us at any time.

Team

We draw from our experience acquiring, managing and underwriting complex re-development projects and have expanded our focus to acquiring cash-flowing properties.

Rachel Goldman- Founder and Principal

Rachel Goldman, is the founding principal of Sterling Development Partners, brings her real estate academic knowledge and business management skills to the firm as well as several Cornell Certificates, Rachel blends her academic knowledge with real-world applications. She’s has been a serial entrepreneur for most of her life, and has developed, manufactured, imported and marketed several of her own patents; including the hit float Bedrock Canopy Luxe, a re-spin of the Flintstones Car, aside from that has owned and sold a restaurant,and has established herself as a team player with extensive and business management skills that help influence her approach to raising capital, aggressive off-market site acquisitions, to lease up. She frequently consults with other local real estate investors on construction, zoning and complex re-developments.She often thinks like her male counterparts in order to succeed in a predominantly male industry.Team members, say, Rachel has innovative imagination who’s unafraid to think outside the box. If she has a goal, she won’t stop until she’s achieved it! She is on the Board of Directors of the Jean A. Battie scholarship fund, and is a member of a number of community-focused organizations including the Urban Land Institute.When she’s not working, the lifelong Sarasota resident, enjoys cycling the legacy trail, skiing the east, and traveling, when she can with her supportive husband and son.

Rod Khleif- Senior Advisor

Rod Khleif- is an entrepreneur, real estate investor, multiple business owner, author, mentor, and community philanthropist who is passionate about business, life, success and giving back. Rod hosts the Multifamily Boardroom Mastermind which has quickly become the largest mastermind of it’s type in the industry with approx. $7 billion in assets represented by the members. Rod has personally owned and managed over 2,000 properties.